Printable Itemized Deductions Worksheet

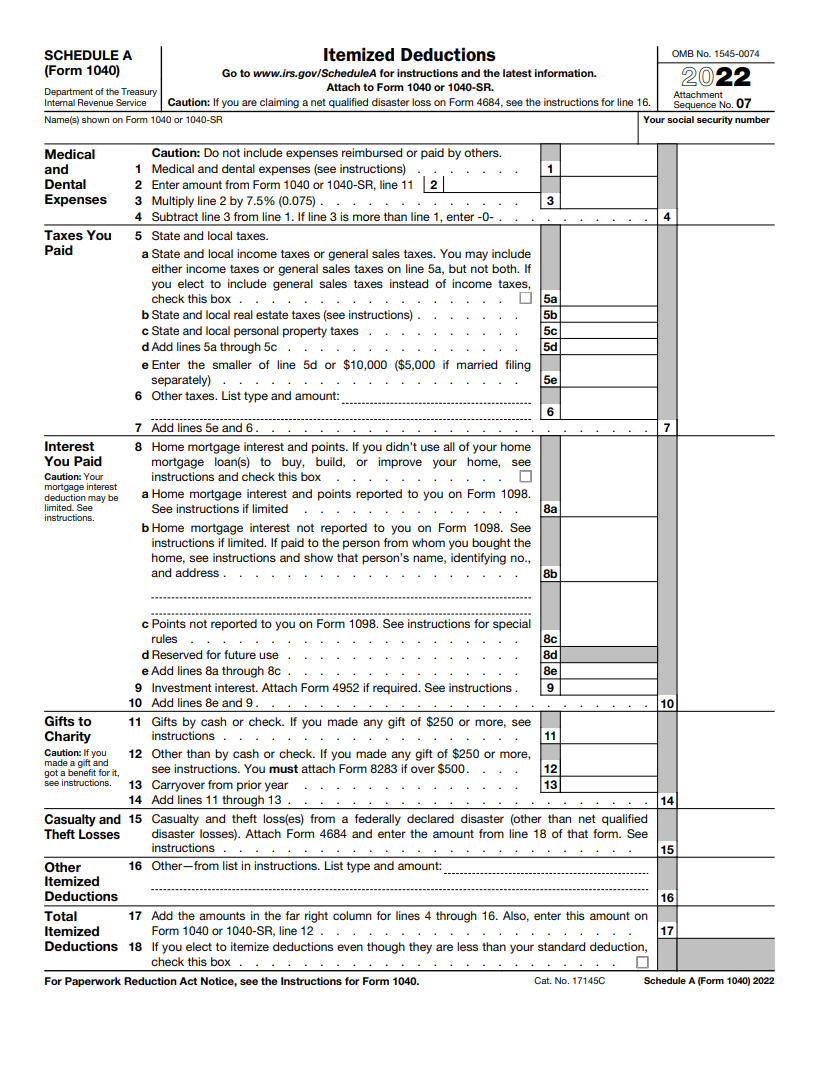

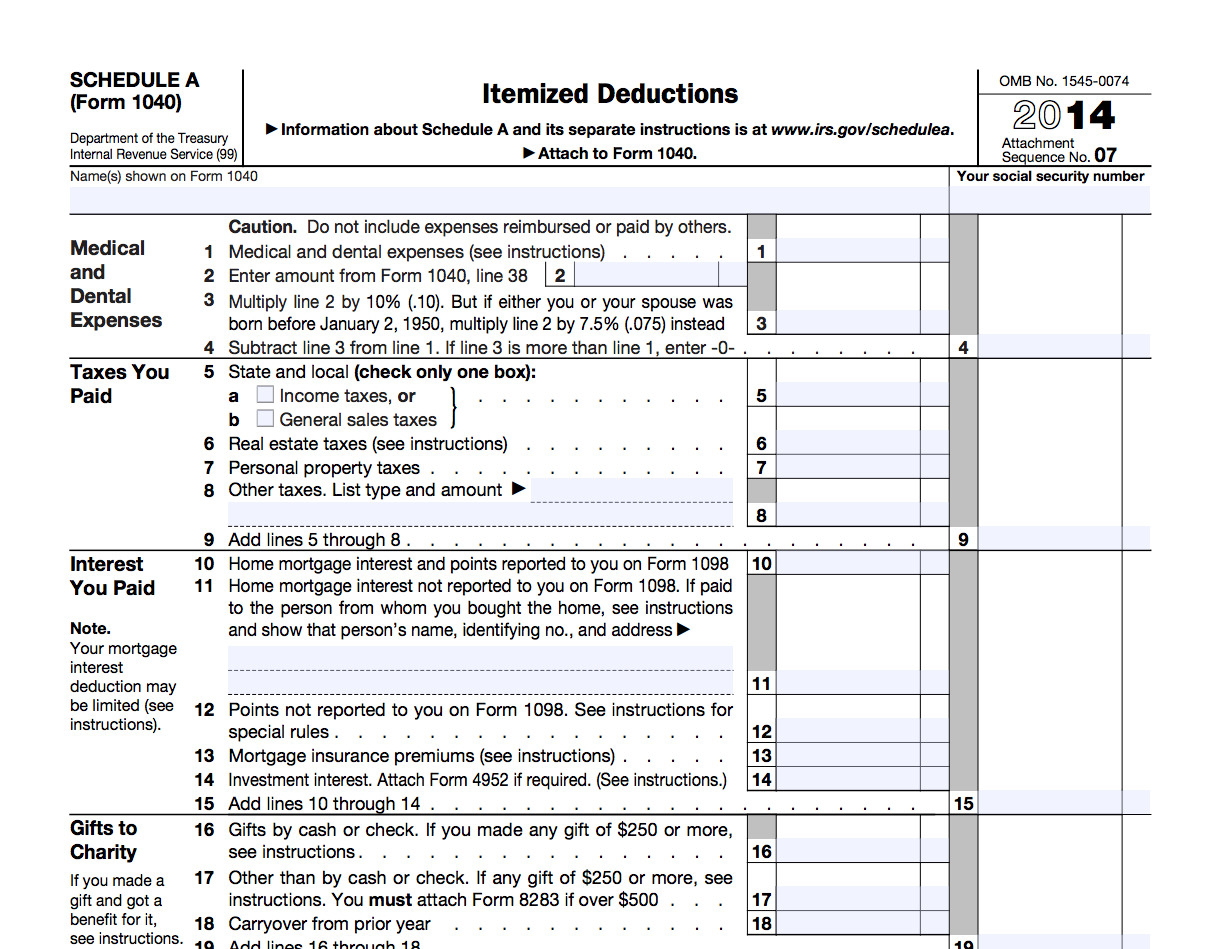

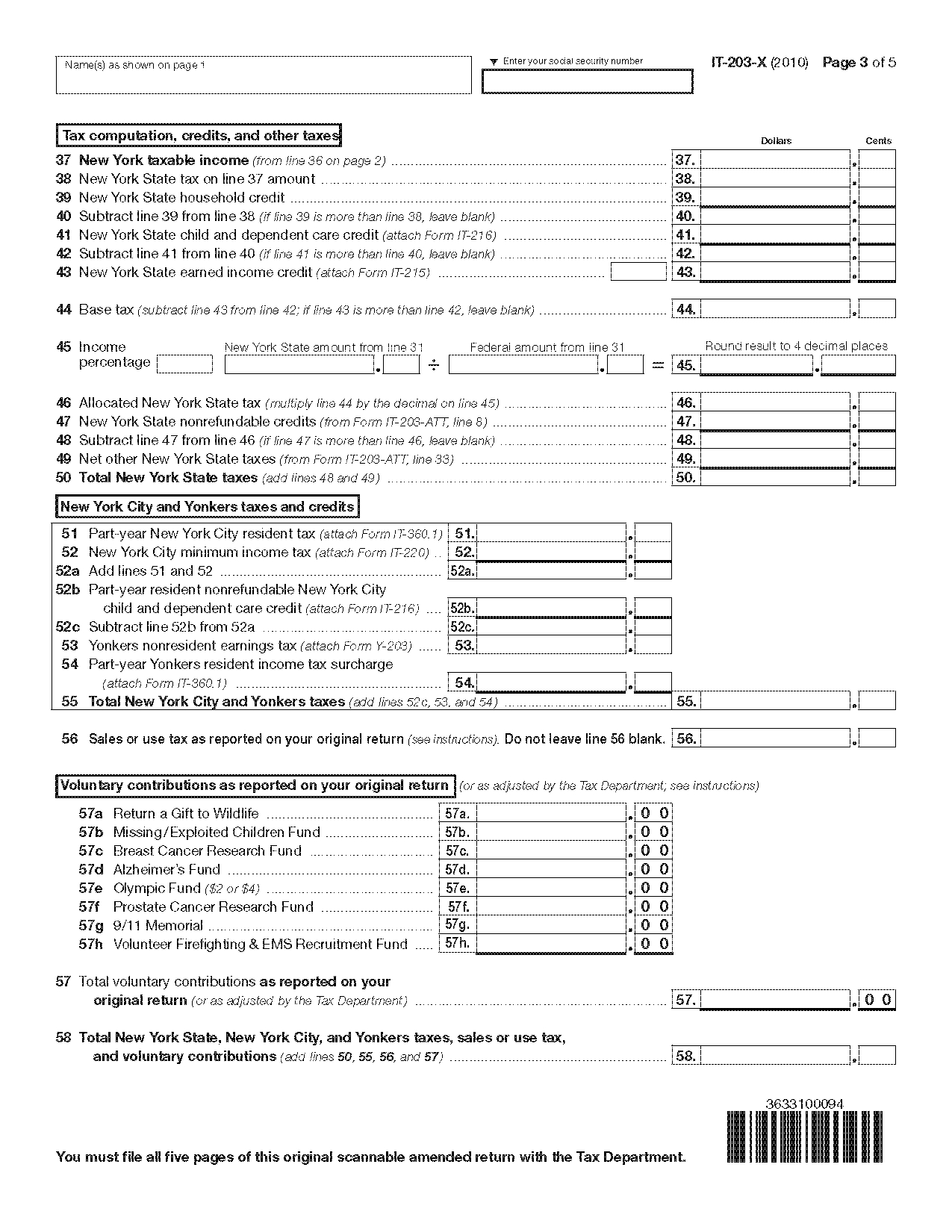

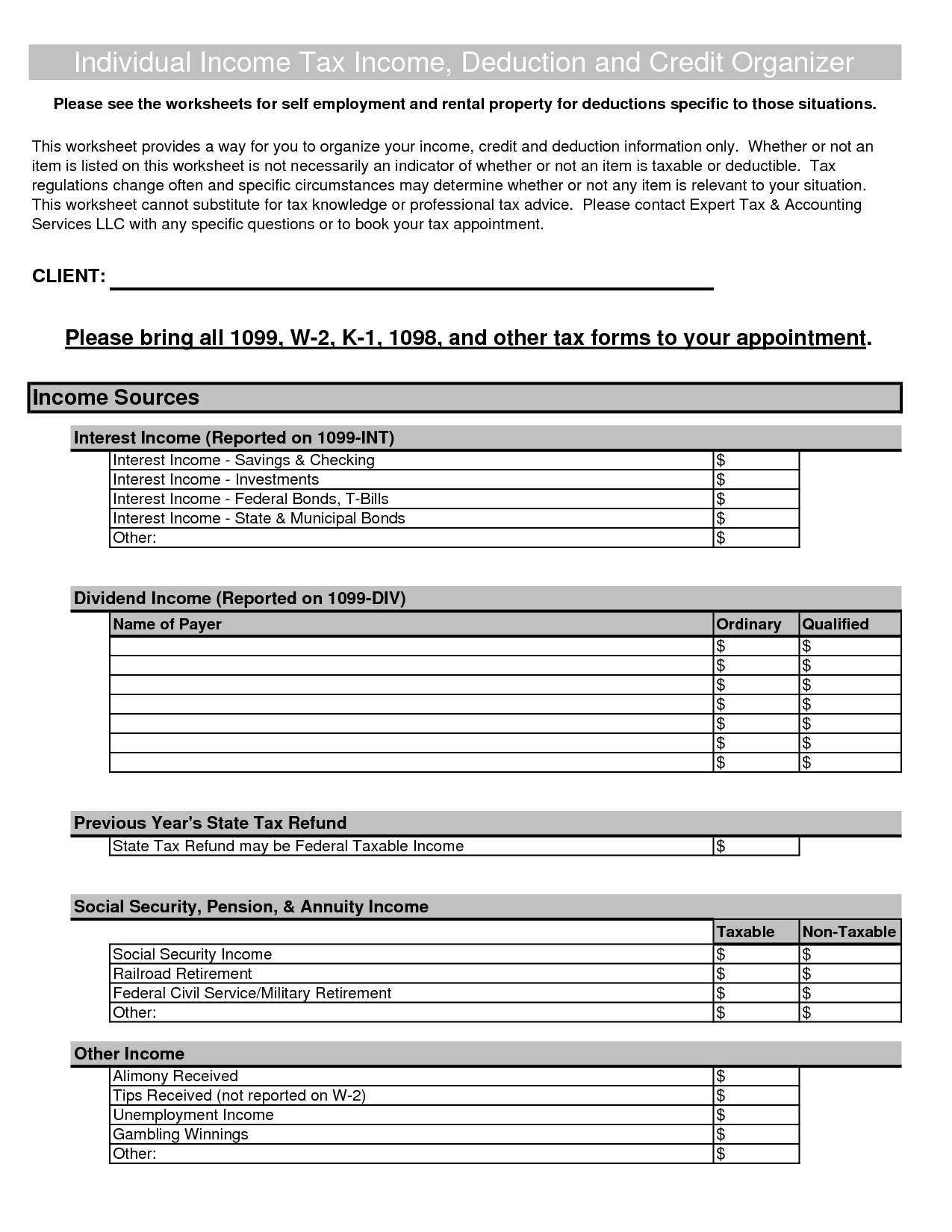

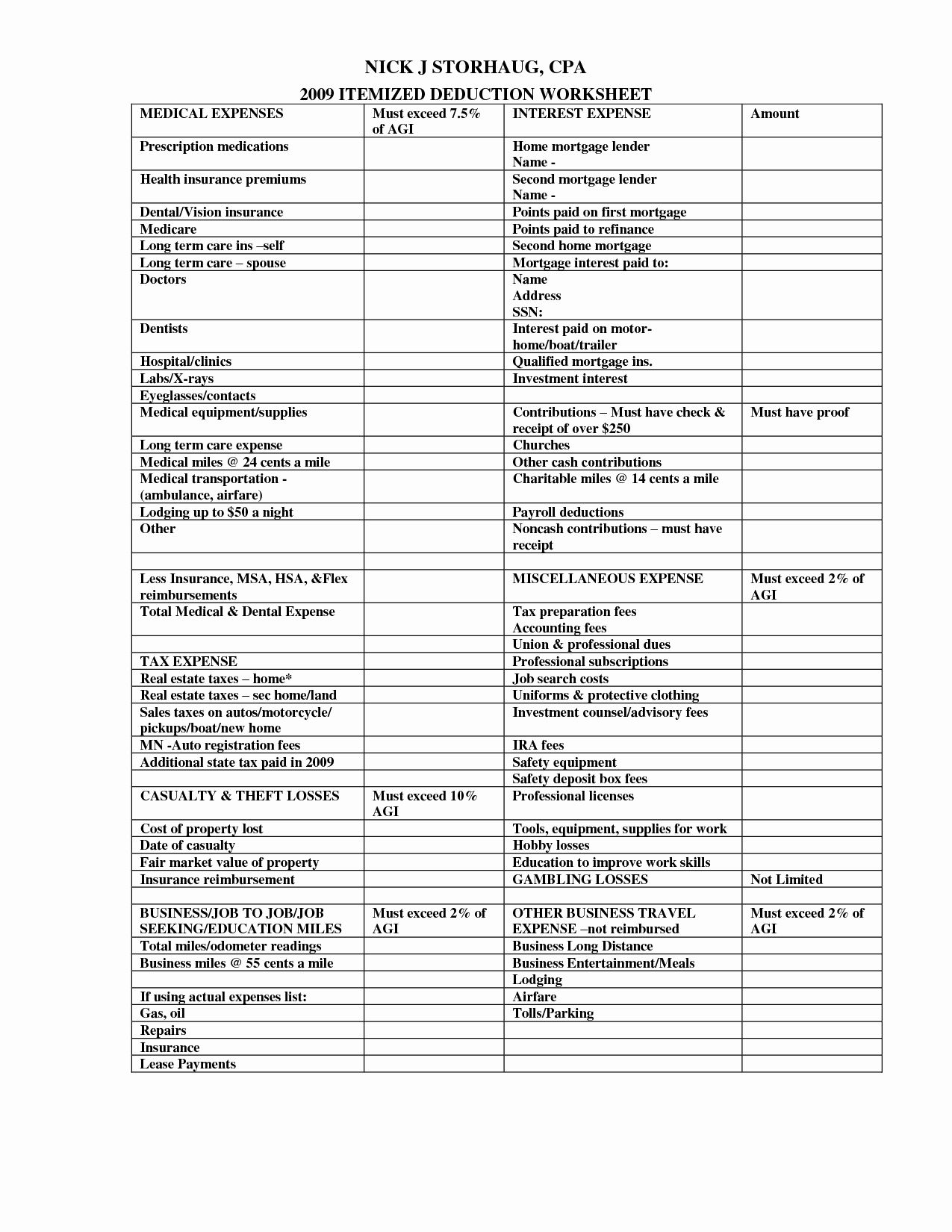

Printable Itemized Deductions Worksheet - $13,850 for singles, $20,800 for heads of household and $27,700 for. Miscellaneous itemized deductions subject to the 2% agi limitation are no longer deductible on the federal return. Go to www.irs.gov/schedulea for instructions and the latest information. Itemized deductions, also known as itemized deduction or itemized deductions form, are specific expenses that qualify for a deduction according to the internal revenue service (irs). We’ll use your 2021 federal standard deduction shown below if more than your itemized deductions above (if blind, add $1,700 or $1,350 if married): Otherwise, reporting total figures on this form. In most cases, your federal income tax will be less if you take the larger of your itemized deductions or your. Your 2023 itemized deduction worksheet itemized deductions need to be more than your standard deduction. Enter the first description, the amount, and. 2023 state taxes paid in 2024 goodwill/salvation army. We’ll use your 2021 federal standard deduction shown below if more than your itemized deductions above (if blind, add $1,700 or $1,350 if married): $14,600 for singles, $21,900 for heads of household and $29,200 for. If you are claiming a net qualified disaster loss on form 4684, see the instructions for line 16. 2023 itemized deductions worksheet for tax filing. Enter the first description, the amount, and. Download these income tax worksheets and organizers to maximize your deductions and minimize errors and omissions. In most cases, your federal income tax will be less if you take the larger of your itemized deductions or your. Your 2024 itemized deduction worksheet itemized deductions need to be more than your standard deduction. Otherwise, reporting total figures on this form. Miscellaneous itemized deductions subject to the 2% agi limitation are no longer deductible on the federal return. Itemized deductions, also known as itemized deduction or itemized deductions form, are specific expenses that qualify for a deduction according to the internal revenue service (irs). Miscellaneous itemized deductions subject to the 2% agi limitation are no longer deductible on the federal return. 2023 itemized deductions worksheet for tax filing. Your 2023 itemized deduction worksheet itemized deductions need to be. If you are claiming a net qualified disaster loss on form 4684, see the instructions for line 16. 2023 state taxes paid in 2024 goodwill/salvation army. $14,600 for singles, $21,900 for heads of household and $29,200 for. Your 2023 itemized deduction worksheet itemized deductions need to be more than your standard deduction. Itemized deductions worksheet you will need: $14,600 for singles, $21,900 for heads of household and $29,200 for. We’ll use your 2023 federal standard deduction shown below if more than your itemized deductions above (if blind, add $1,850 or $1,500 if married): 2023 itemized deductions worksheet for tax filing. Download the free itemized deductions checklist to keep track of your tax information throughout the entire year. Itemized. We’ll use your 2021 federal standard deduction shown below if more than your itemized deductions above (if blind, add $1,700 or $1,350 if married): However, these expenses may still be deductible on your state return. Itemized deductions, also known as itemized deduction or itemized deductions form, are specific expenses that qualify for a deduction according to the internal revenue service. We’ll use your 2024 federal standard deduction shown below if more than your itemized deductions above (if blind, add $1,950 or $1,550 if married): $14,600 for singles, $21,900 for heads of household and $29,200 for. Download these income tax worksheets and organizers to maximize your deductions and minimize errors and omissions. We’ll use your 2021 federal standard deduction shown below. However, these expenses may still be deductible on your state return. Itemized deductions, also known as itemized deduction or itemized deductions form, are specific expenses that qualify for a deduction according to the internal revenue service (irs). We’ll use your 2021 federal standard deduction shown below if more than your itemized deductions above (if blind, add $1,700 or $1,350 if. Go to www.irs.gov/schedulea for instructions and the latest information. 2023 itemized deductions worksheet for tax filing. However, these expenses may still be deductible on your state return. This worksheet helps you itemize deductions for your 2023 tax return. Enter the first description, the amount, and. Go to www.irs.gov/schedulea for instructions and the latest information. Download these income tax worksheets and organizers to maximize your deductions and minimize errors and omissions. Itemized deductions, also known as itemized deduction or itemized deductions form, are specific expenses that qualify for a deduction according to the internal revenue service (irs). Your 2024 itemized deduction worksheet itemized deductions need to. However, keep in mind that your property taxes of up to $10,000 are an itemized deduction, too—and combined with mortgage interest and other deductions, could push you. Download the free itemized deductions checklist to keep track of your tax information throughout the entire year. 2023 itemized deductions worksheet for tax filing. We’ll use your 2023 federal standard deduction shown below. In most cases, your federal income tax will be less if you take the larger of your itemized deductions or your. It's essential for accurately reporting deductible expenses like medical. We’ll use your 2021 federal standard deduction shown below if more than your itemized deductions above (if blind, add $1,700 or $1,350 if married): Download these income tax worksheets and. We’ll use your 2024 federal standard deduction shown below if more than your itemized deductions above (if blind, add $1,950 or $1,550 if married): Enter the first description, the amount, and. Otherwise, reporting total figures on this form. If you are claiming a net qualified disaster loss on form 4684, see the instructions for line 16. 2023 itemized deductions worksheet for tax filing. However, these expenses may still be deductible on your state return. We’ll use your 2021 federal standard deduction shown below if more than your itemized deductions above (if blind, add $1,700 or $1,350 if married): We’ll use your 2021 federal standard deduction shown below if more than your itemized deductions above (if blind, add $1,700 or $1,350 if married): Download the free itemized deductions checklist to keep track of your tax information throughout the entire year. We’ll use your 2022 federal standard deduction shown below if more than your itemized deductions above (if blind, add $1,750 or $1,400 if married): Download or print the 2024 federal (itemized deductions) (2024) and other income tax forms from the federal internal revenue service. Miscellaneous itemized deductions subject to the 2% agi limitation are no longer deductible on the federal return. $13,850 for singles, $20,800 for heads of household and $27,700 for. This worksheet helps you itemize deductions for your 2023 tax return. Download these income tax worksheets and organizers to maximize your deductions and minimize errors and omissions. Your 2023 itemized deduction worksheet itemized deductions need to be more than your standard deduction.Schedule A (Form 1040) A Guide to the Itemized Deduction Worksheets

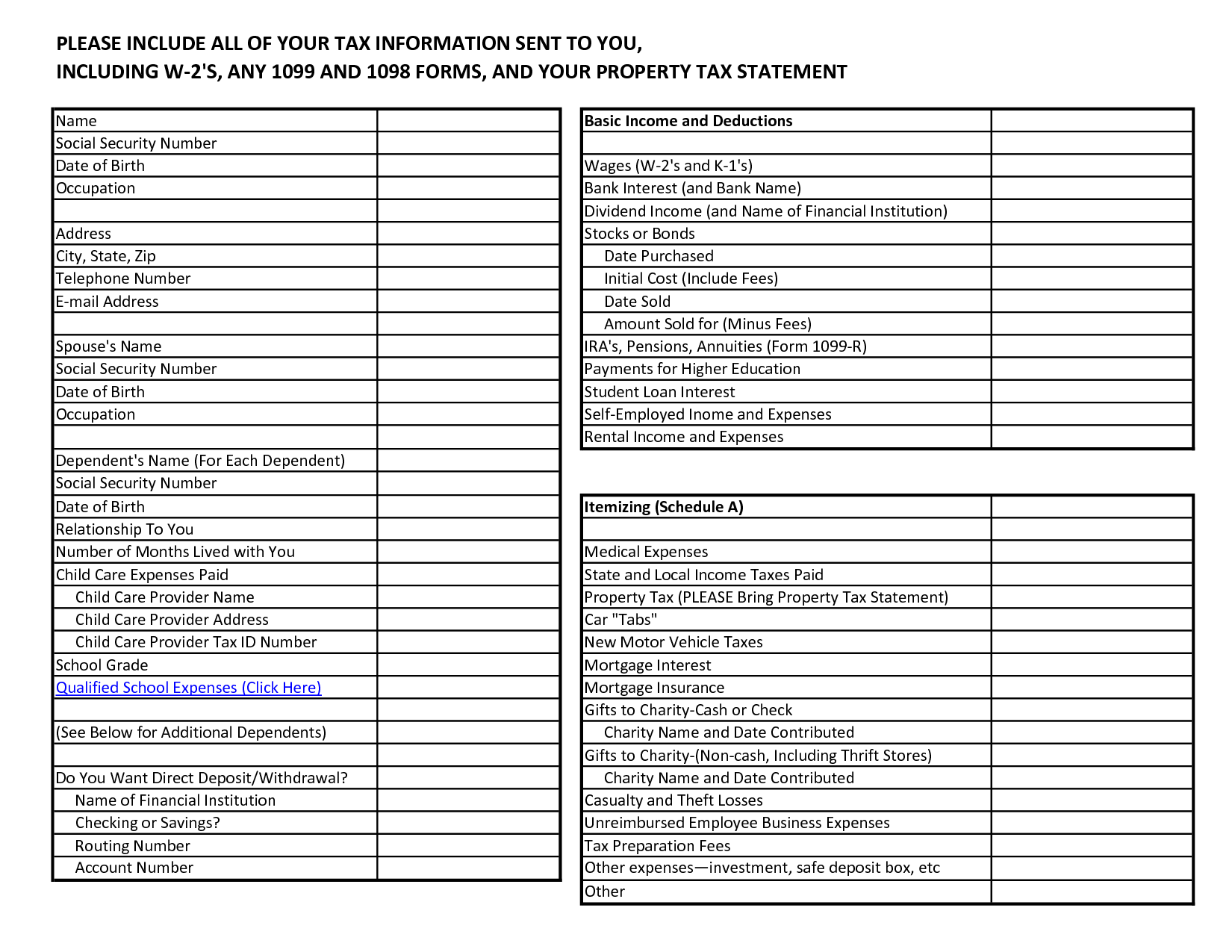

Tax Deductions Worksheets

Printable Itemized Deductions Worksheet

Itemized Deductions Worksheet —

Tax Deductions Tax Deductions Worksheet —

Printable Itemized Deductions Worksheet

Printable Itemized Deductions Worksheet

18 Itemized Deductions Worksheet Printable /

itemized deductions worksheet 20212022 Fill Online, Printable

Itemized Deduction Small Business Tax Deductions Worksheet

Itemized Deductions, Also Known As Itemized Deduction Or Itemized Deductions Form, Are Specific Expenses That Qualify For A Deduction According To The Internal Revenue Service (Irs).

The Source Information That Is Required For Each Tax Return Is.

Tax Information Documents (Receipts, Statements, Invoices, Vouchers) For Your Own Records.

Go To Www.irs.gov/Schedulea For Instructions And The Latest Information.

Related Post: