Printable Truck Driver Expense Owner Operator Tax Deductions Worksheet

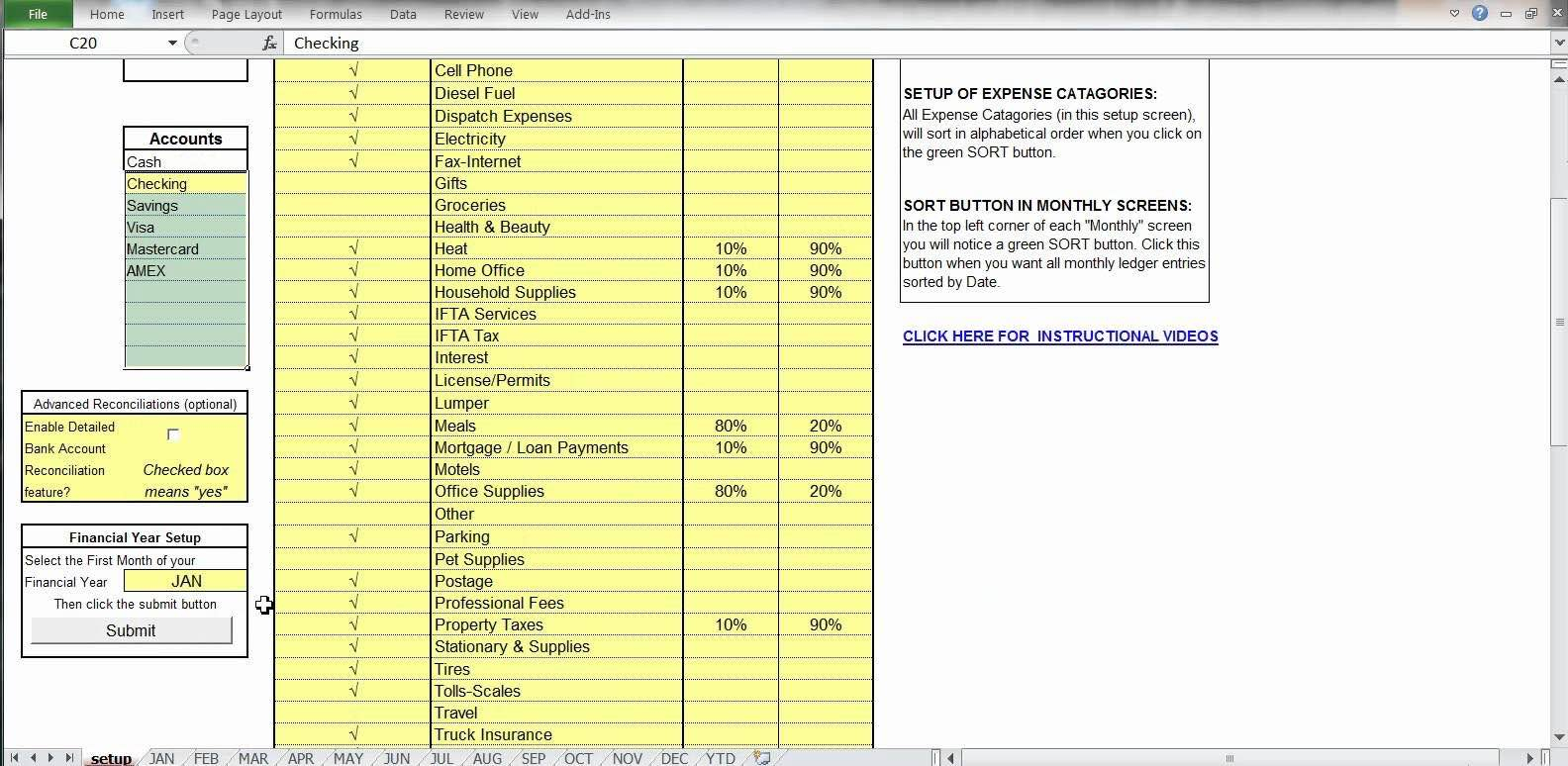

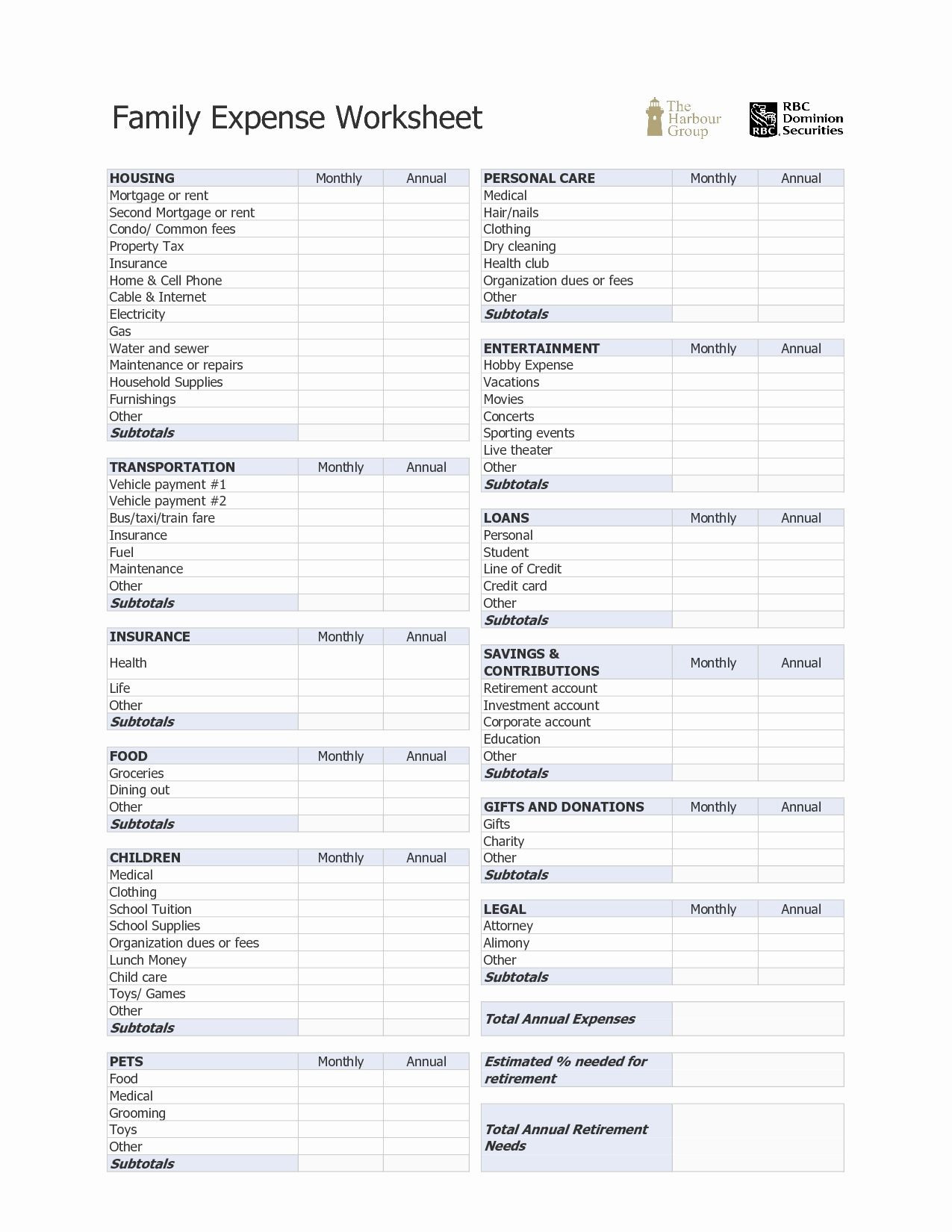

Printable Truck Driver Expense Owner Operator Tax Deductions Worksheet - Expenses are deductible only if you itemize deductions. Up to $50 cash back truck driver tax deductions are designed to reduce the amount of taxes owed by truck drivers at the end of the year. Truck driver tax deductions the purpose of this worksheet is to help you organize your tax deductible business expenses. Here are some suggestions to help you. Diesel fuel expense is one of the largest expenses for truckers and owner operators in a tax year. One of them includes the ability to determine and utilize the deductions you are eligible for, minimizing some of the available financial risks, increasing your revenues, or even. Here are the tax deductions & expense list for truckers & truck driver: These deductions can be used to reduce the. Below are potential opportunities to save on your. It is designed to simplify tax filing requirements and maximize deductions. Expenses are deductible only if you itemize deductions. It is designed to simplify tax filing requirements and maximize deductions. Up to $50 cash back truck driver tax deductions are designed to reduce the amount of taxes owed by truck drivers at the end of the year. Diesel fuel expense is one of the largest expenses for truckers and owner operators in a tax year. Here are some suggestions to help you. Use a truck driver tax deductions worksheet template to make your document workflow more streamlined. Finding and tracking tax deductions for truck drivers can help you save more to protect your business. Here are the tax deductions & expense list for truckers & truck driver: C itizens band rad o. One of them includes the ability to determine and utilize the deductions you are eligible for, minimizing some of the available financial risks, increasing your revenues, or even. This deductible expenses worksheet helps otr drivers organize tax deductible business expenses. Expenses are deductible only if you itemize deductions. Use a truck driver tax deductions worksheet template to make your document workflow more streamlined. Up to $50 cash back truck driver tax deductions are designed to reduce the amount of taxes owed by truck drivers at the end of. Finding and tracking tax deductions for truck drivers can help you save more to protect your business. This deductible expenses worksheet helps otr drivers organize tax deductible business expenses. Here are the tax deductions & expense list for truckers & truck driver: Here are some suggestions to help you. Up to $50 cash back truck driver tax deductions are expenses. Use a truck driver tax deductions worksheet template to make your document workflow more streamlined. These deductions can be used to reduce the. Here are the tax deductions & expense list for truckers & truck driver: In order for an expense to be deductible, it must be considered. Up to $50 cash back truck driver tax deductions are designed to. Here are some suggestions to help you. In order for an expense to be deductible, it must be considered. Diesel fuel expense is one of the largest expenses for truckers and owner operators in a tax year. C itizens band rad o. Below are potential opportunities to save on your. Truck driver tax deductions the purpose of this worksheet is to help you organize your tax deductible business expenses. Here are the tax deductions & expense list for truckers & truck driver: Up to $50 cash back truck driver tax deductions are designed to reduce the amount of taxes owed by truck drivers at the end of the year. This. It is designed to simplify tax filing requirements and maximize deductions. This deductible expenses worksheet helps otr drivers organize tax deductible business expenses. Here are some suggestions to help you. Here are the tax deductions & expense list for truckers & truck driver: One of them includes the ability to determine and utilize the deductions you are eligible for, minimizing. In order for an expense to be deductible, it must be considered. Diesel fuel expense is one of the largest expenses for truckers and owner operators in a tax year. Here are the tax deductions & expense list for truckers & truck driver: Up to $50 cash back truck driver tax deductions are designed to reduce the amount of taxes. Finding and tracking tax deductions for truck drivers can help you save more to protect your business. Up to $50 cash back truck driver tax deductions are designed to reduce the amount of taxes owed by truck drivers at the end of the year. Here are the tax deductions & expense list for truckers & truck driver: Read on to. Here are some suggestions to help you. This deductible expenses worksheet helps otr drivers organize tax deductible business expenses. Below are potential opportunities to save on your. C itizens band rad o. Finding and tracking tax deductions for truck drivers can help you save more to protect your business. In order for an expense to be deductible, it must be considered. Below are potential opportunities to save on your. Truck driver tax deductions the purpose of this worksheet is to help you organize your tax deductible business expenses. C itizens band rad o. Here are some suggestions to help you. Finding and tracking tax deductions for truck drivers can help you save more to protect your business. Here are the tax deductions & expense list for truckers & truck driver: This deductible expenses worksheet helps otr drivers organize tax deductible business expenses. Here are some suggestions to help you. Read on to find the best deductions for your company. Up to $50 cash back truck driver tax deductions are designed to reduce the amount of taxes owed by truck drivers at the end of the year. It is designed to simplify tax filing requirements and maximize deductions. One of them includes the ability to determine and utilize the deductions you are eligible for, minimizing some of the available financial risks, increasing your revenues, or even. Use a truck driver tax deductions worksheet template to make your document workflow more streamlined. These deductions can be used to reduce the. Diesel fuel expense is one of the largest expenses for truckers and owner operators in a tax year. C itizens band rad o. Up to $50 cash back truck driver tax deductions are expenses that truck drivers can deduct from their taxable income, reducing the amount of tax they owe.Truck Driver Tax Deductions Worksheet Truck Driver T Trucker

Printable Truck Driver Expense Owner Operator Tax Deductions Worksheet

Tax Deduction Worksheet For Truck Drivers Printable Word Searches

Printable Truck Driver Expense Owner Operator Tax Deductions

Truck Driver Tax Expense Deductions List

Truck Driver Tax Deductions Worksheet Truck Driver T Trucker

Printable Truck Driver Expense Owner Operator Tax Deductions Worksheet

Truck Driver Expenses Worksheet Tax Worksheet Deductions Exp

Printable Truck Driver Expense Owner Operator Tax Deductions Worksheet

Truck Driver Tax Expense Worksheet

In Order For An Expense To Be Deductible, It Must Be Considered.

Expenses Are Deductible Only If You Itemize Deductions.

Truck Driver Tax Deductions The Purpose Of This Worksheet Is To Help You Organize Your Tax Deductible Business Expenses.

Below Are Potential Opportunities To Save On Your.

Related Post: